NVIDIA made a calculated announcement at CES 2026 this week, unveiling DLSS 4.5 while explicitly confirming no new graphics cards would debut at the show. The move breaks a five-year streak of CES GPU launches and underscores how component shortages and AI priorities have reshaped the company’s gaming roadmap.

DLSS 4.5: Iterative Improvements, Not Revolution

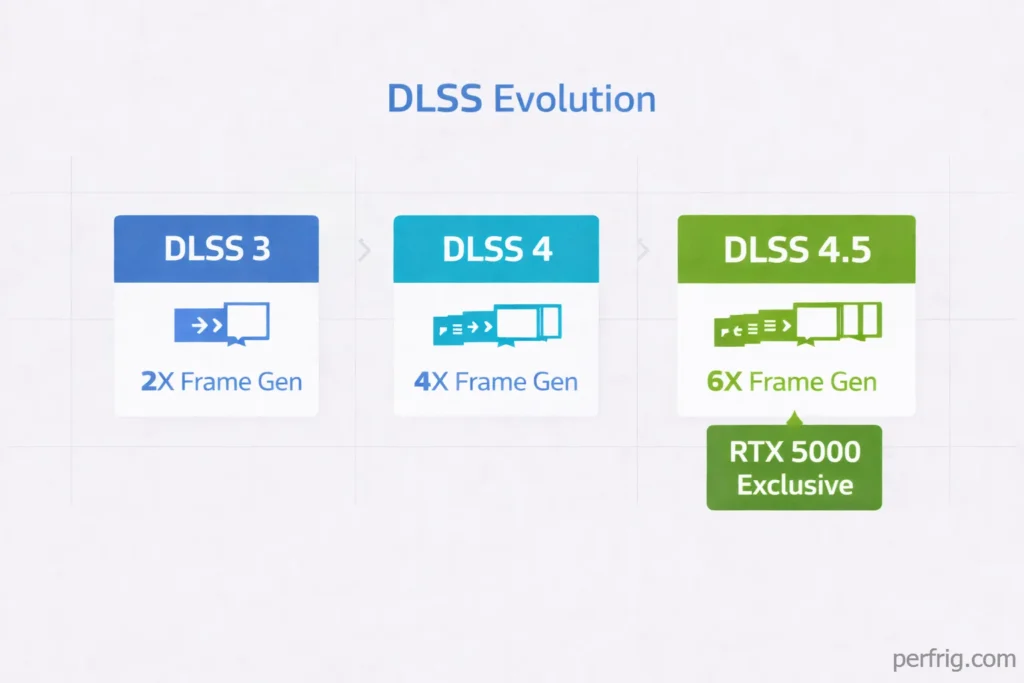

NVIDIA’s gaming showcase focused on DLSS 4.5, an update to the company’s AI-powered upscaling technology. The upgrade introduces a second-generation transformer model improving image quality, better ghosting reduction, and enhanced temporal stability.

The headline feature is 6x Dynamic Multi Frame Generation, expanding from the current 4x maximum. This technology generates up to five interpolated frames between each rendered frame, theoretically enabling 240+ FPS gaming at 4K resolution with path tracing enabled.

DLSS 4.5 Super Resolution launches immediately for all RTX 2000 through 5000 series GPUs. Users can enable it through the NVIDIA app by selecting “Latest” in the DLSS Override feature. The full release arrives January 13.

The Dynamic 6x Multi Frame Generation feature, however, remains exclusive to RTX 5000 series cards and won’t launch until spring 2026. This timing places the feature months after the current component crisis potentially eases, though no concrete availability improvements are forecast.

No RTX 5000 Super Series at CES

The official NVIDIA GeForce account confirmed via social media that “no new GPUs will be announced” at CES 2026. This statement ended months of speculation about RTX 5080 Super and RTX 5070 Ti Super launches.

Industry rumors had suggested RTX 5000 Super cards could arrive at CES, matching the RTX 40 Super series timeline from CES 2024. The rumored specifications included upgraded VRAM—24GB for the RTX 5080 Super versus the current 16GB, and potentially 24GB for the RTX 5070 Ti Super as well.

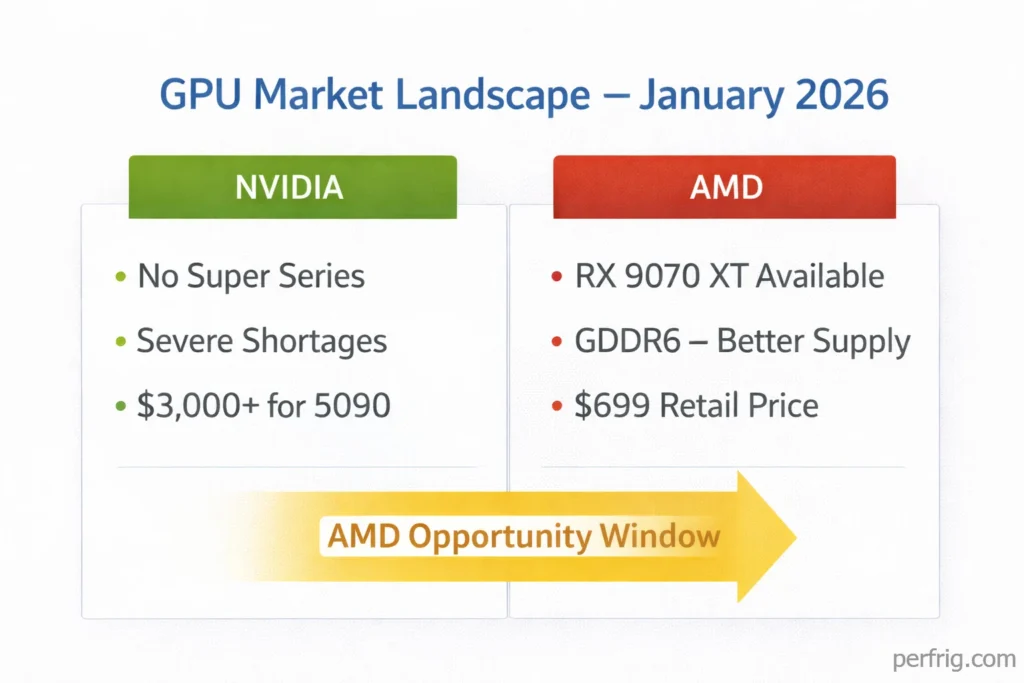

The delay stems from the ongoing GDDR7 memory shortage affecting the entire graphics card industry. NVIDIA’s RTX 5000 series uses GDDR7 exclusively, and production capacity has been redirected toward AI datacenter products where profit margins far exceed consumer gaming GPUs.

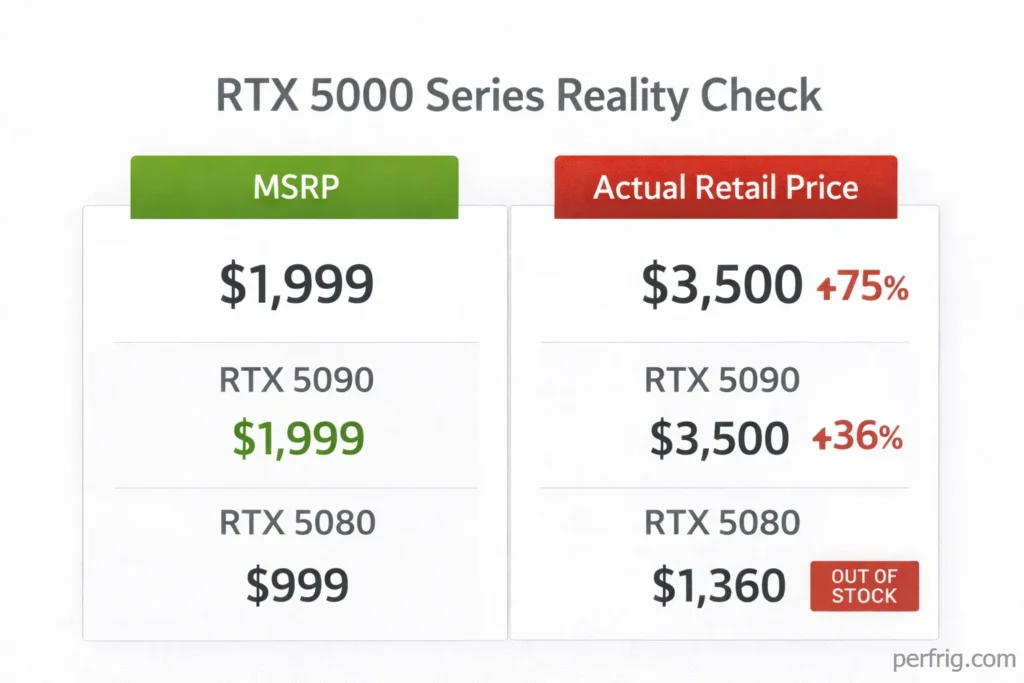

Current RTX 5000 series cards face severe availability constraints and pricing inflation. The RTX 5090 sells for $3,000-$4,000 at retail despite a $1,999 MSRP, while the RTX 5080 averages $1,360 versus its $999 list price. These conditions make launching additional SKUs impractical.

The Component Crisis Context

The GDDR7 shortage represents the collision of gaming hardware with AI demand. Manufacturers producing memory for consumer GPUs also supply HBM and GDDR7 for AI accelerators, which command higher prices and larger orders from companies building datacenter infrastructure.

NVIDIA holds a dominant position in the AI market, with a market valuation exceeding $4.5 trillion. The company’s CES presentation dedicated substantial time to AI advancements—LLM performance improvements, AI-powered content creation tools, and datacenter innovations.

Gaming products, by comparison, represent a shrinking portion of NVIDIA’s business despite the GeForce brand building the company’s reputation. CEO Jensen Huang acknowledged this shift during a CES Q&A, suggesting NVIDIA might “engineer our latest-generation AI technology” to work with older GeForce cards rather than prioritizing new gaming GPU launches.

This statement hints at bringing RTX 5000 exclusive features like DLSS 4 Multi Frame Generation to RTX 40 and 30 series cards. Huang noted this “requires a fair amount of engineering” but could help address criticism that NVIDIA has abandoned gamers.

AMD’s Opportunity Window

NVIDIA’s decision not to launch RTX 5000 Super cards creates an opening for AMD. The company’s CEO Lisa Su delivered a keynote at CES 2026, though specific GPU announcements focused on laptop and desktop processors rather than new graphics cards.

AMD’s RDNA 4 architecture launched in March 2025 with the RX 9070 XT ($599) and RX 9070 ($549). These cards target mainstream gaming rather than high-end enthusiast users, competing against NVIDIA’s RTX 5070 Ti and RTX 5070.

Current pricing shows RX 9070 XT cards at $699 retail versus the $599 MSRP—modest inflation compared to NVIDIA’s products. Availability has improved since launch, with most models in stock at major retailers. AMD’s decision to use GDDR6 memory rather than GDDR7 insulates RDNA 4 from the worst supply constraints.

Rumors suggest AMD is developing an RX 9080 XT targeting high-end performance, potentially competing with the RTX 5080. If this card exists, NVIDIA’s CES absence provides AMD an opportunity to capture mindshare in the $700-$1,000 segment.

Intel’s Battlemage Quietly Gains Ground

Intel’s Arc B580 and B570 graphics cards launched in late 2025 targeting the budget segment. These cards retail at $250-$280, offering competitive 1080p and 1440p gaming performance.

While Intel can’t compete with NVIDIA or AMD at the high end, the mid-range market looks increasingly attractive as RTX 5070 and RX 9070 series cards face pricing pressure. Intel’s cards use GDDR6 memory, avoiding supply issues affecting GDDR7-equipped products.

Sales data remains limited, but availability has been solid since launch. Intel’s modest market share goals—capturing even 5% of the discrete GPU market would represent success—make Battlemage a low-risk play that could benefit from competitors’ supply constraints.

G-SYNC Pulsar and Gaming Monitors

NVIDIA’s CES gaming announcements extended beyond DLSS. The company launched G-SYNC Pulsar technology, promising over 1,000 Hz of effective motion clarity through advanced backlight strobing techniques.

Monitors featuring G-SYNC Pulsar from ASUS, Acer, and AOC become available January 7, 2026. Pricing starts around $800 for 27-inch 1440p models, positioning these displays as premium gaming monitors rather than mainstream options.

The technology demonstrates NVIDIA’s continued investment in the gaming ecosystem beyond graphics cards. However, $800+ monitors face the same affordability challenges as GPUs—most gamers can’t justify premium pricing during a component crisis.

Looking Ahead

NVIDIA’s CES strategy reflects a company prioritizing AI revenue over gaming hardware launches it cannot adequately supply. DLSS 4.5 provides a software-focused announcement that benefits existing GPU owners without creating new products destined for immediate sellouts and price gouging.

The absence of RTX 5000 Super cards suggests launches won’t occur until component supplies stabilize. Industry sources estimate relief won’t arrive until late 2026 or early 2027 as new GDDR7 production capacity comes online.

For gamers, the message is clear: the GPU market won’t improve in the first half of 2026. Those needing graphics cards should consider AMD’s RX 9070 series for better availability, older-generation RTX 4000 cards if findable at reasonable prices, or waiting until fall 2026 for potential market improvements.

NVIDIA’s gaming division hasn’t disappeared, but it’s clearly secondary to AI business. The company’s $4.5 trillion valuation and record AI chip sales mean consumer gaming represents a rounding error in quarterly earnings. Whether this changes once component supplies normalize remains to be seen, but CES 2026 made NVIDIA’s current priorities unmistakable.